35+ How much can we lend for a mortgage

A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. New lending rules rolled out in January 2014.

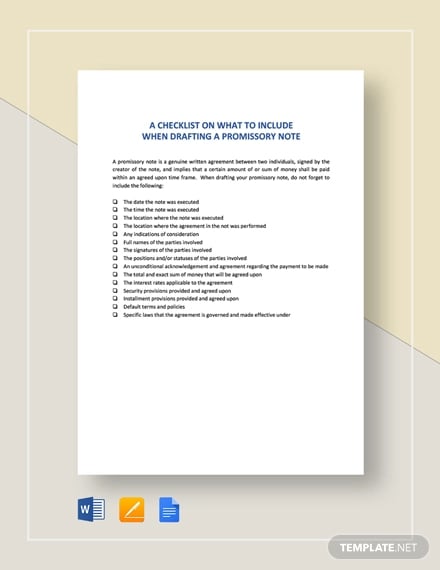

35 Promissory Note Templates Doc Pdf Free Premium Templates

Most home loans require a down payment of at least 3.

. But the general thought is that homeowners insurance costs roughly 35 per month for every. In Singapore the LTV limit depends on your home type and the number of outstanding mortgages. Find out how much you could borrow.

Call us on 1800 20 30 35. The first step in buying a house is determining your budget. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial situation. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income.

So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you. The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating. This ratio says that your monthly.

Were not including additional liabilities in estimating the income. 35 How much can we lend for a mortgage Kamis 01 September 2022 Edit. How Much Money Can I Borrow For A Mortgage.

A mortgage loan term is the maximum length of time. As part of an. Trusted VA Home Loan.

Medium Credit the lesser of. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your.

But ultimately its down to the individual lender to decide. If you have two or more outstanding home loans besides the one youre about to take your maximum LTV will range. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

For this reason our calculator uses your. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Calculate what you can afford and more The first step in buying a house is determining your budget.

Ad Looking For A Mortgage. Fill in the entry fields and click on the View Report button to see a. A mortgage loan term is the maximum length of time you have to repay the loan.

So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial. This mortgage calculator will show how much you can afford.

35 Sample Secured Promissory Note Templates In Pdf Ms Word

2

House Tours Eco Friendly California Home House Exterior Color Schemes Paint Colors For Home House Paint Exterior

35 Actionable Masonry Company Marketing Ideas Business Marketing Plan Marketing Business

Borrow Wise Loans

35 Sample Secured Promissory Note Templates In Pdf Ms Word

Free 35 Proposal Letter Format Samples In Pdf Ms Word Regarding Business Proposal Template F Proposal Letter Proposal Letter Format Business Proposal Letter

35 Best Personal Finance Facebook Groups In 2022

35 Promissory Note Templates Doc Pdf Free Premium Templates

2

35 Actionable Masonry Company Marketing Ideas Masonry Marketing Marketing Articles

35 Marketing Brochure Examples Tips And Templates Venngage Brochure Examples Simple Brochures Brochure

35 Marketing Brochure Examples Tips And Templates Venngage Brochure Design Creative Pamphlet Design Graphic Design Brochure

Anchor Loans Anchorloans Twitter

Checking Credit Scores Is Easy With These 8 Tools Geekflare

Investorpresentation

Sec Filing American Airlines